Sick Pay Calculator

Calculate sick pay for your employees

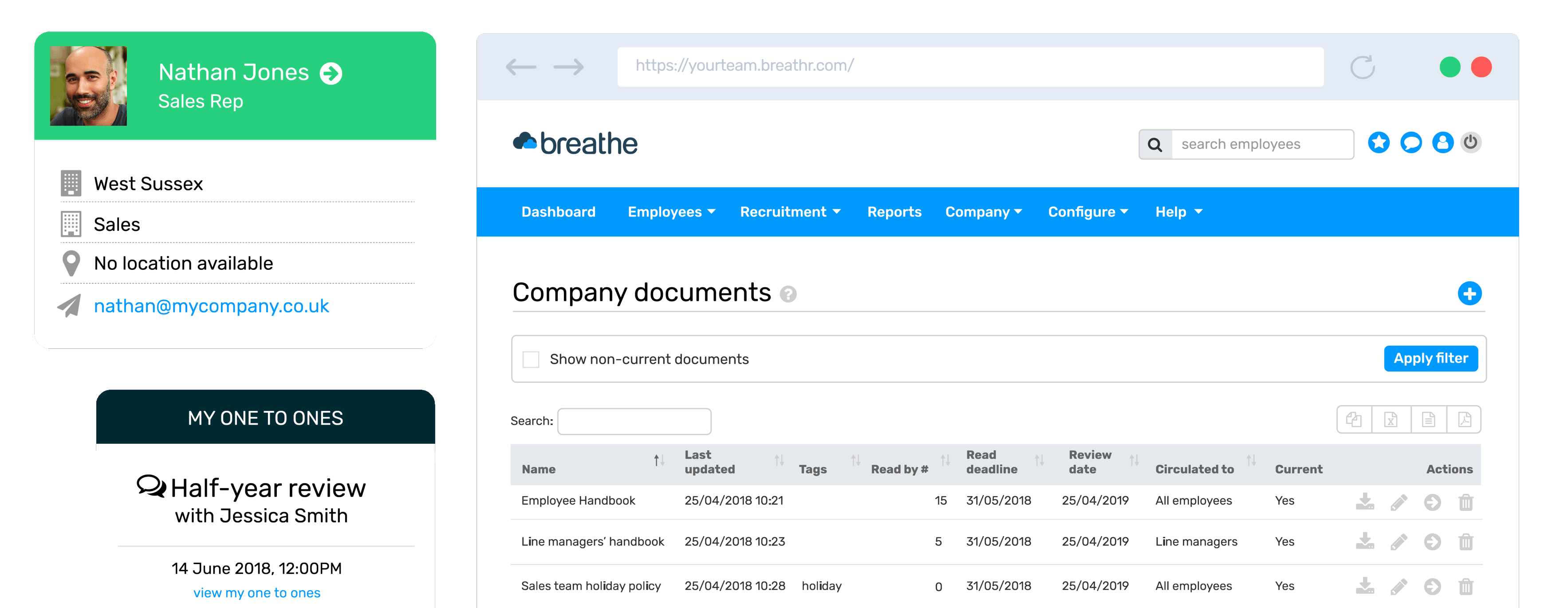

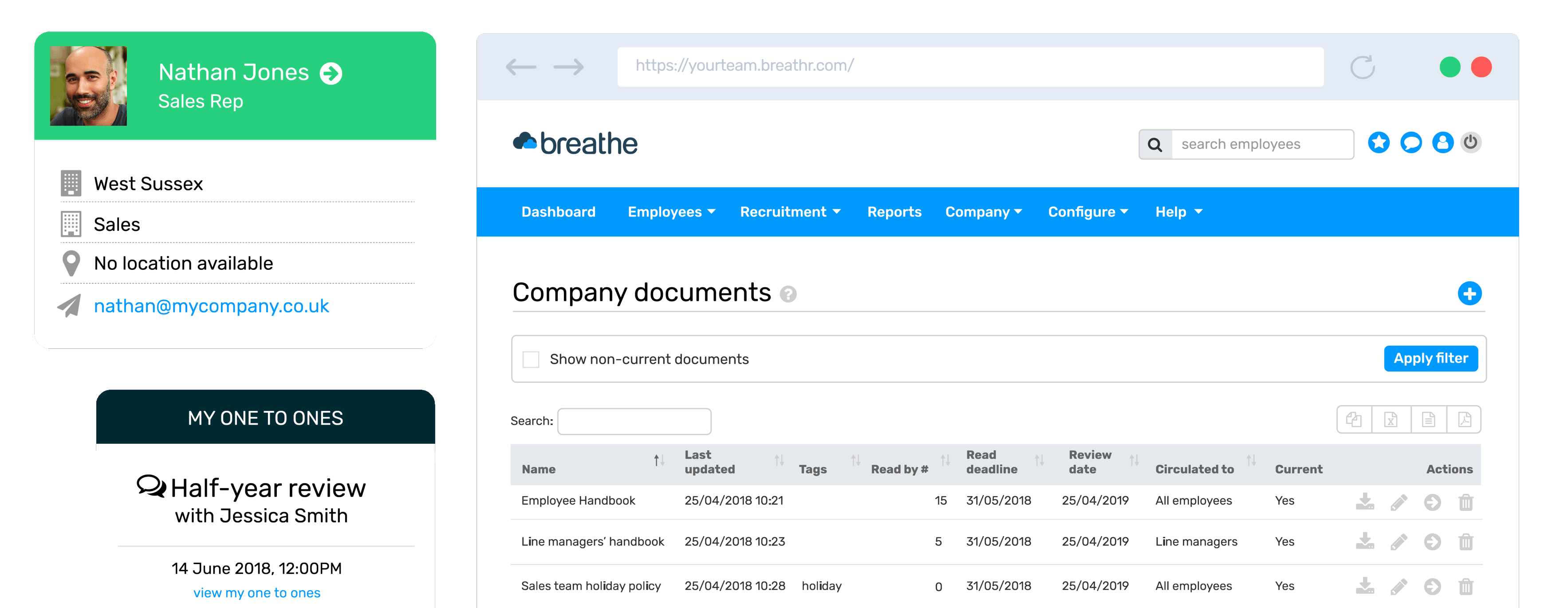

Never lose track of your hard work. Breathe’s software gives you automatically generated tasks and email reminders to keep you on track.

Give your people total visibility of how much holiday they're entitled to and how much has been taken

Use the manager dashboard to monitor employee absence with central calendar and report functionality.

Use flexible line manager and employee permissions to simplify your day and encourage team autonomy.

Our sick pay calculator can help you quickly work out what statutory sick pay (SSP) your employees are eligible for. Simply enter your employee’s monthly wage before tax, plus the information about when they are paid and how many days they have been away. The calculator will automatically calculate if your employee is eligible and how much they will be due in SSP.

If you need to find out how much statutory sick pay you need to pay your employee, first see if they’re eligible for SSP. You can then calculate how much they will be due in their absence.

Monthly pay before deductions

Last payday before the first day of sickness

Payday at least 8 weeks before first day of sickness

Is the employee currently receiving maternity pay or employment support?

Eligible for SSP

How many days has the employee been off sick?

Has the employee received SSP in the last 8 weeks?

Monthly pay before deductions

Is the employee currently receiving maternity pay or employment support?

Eligible for SSP

How many days has the employee been off sick?

Has the employee received SSP in the last 8 weeks?

£0.00

SSP

(total)

At some point your employees will be affected by sickness and will have to take time off work. When this happens, your employees will be eligible for statutory sick pay. This form of sick pay is the legal minimum that your employee will be entitled to when they are sick. This pay will be supplied by you and will start once the employee is off sick for more than four days in a row.

Unlike SSP, company sick pay is financial sickness covered at the discretion of the employer and is not bound by law. This can take several forms, including paying the workers for the first 3 days before SSP starts or topping the sick pay up by £50 a week. Some employers may decide to give employees their full salary for a set period of time. As long as the occupational pay is more than SSP it is completely up to the employer. Paying company sick pay may sound counter-intuitive. Why pay for an employee to be ill? But company sick pay can help attract the very best talent, boost morale and with that, productivity. It can also work to reduce sickness and boost productivity office wide, by encouraging ill individuals not to come in and spread coughs and colds. For some illnesses employees may still feel able to work. In these situations it will be wise to look at a good remote working policy.

As an employer, there are a few things to remember when it comes to paying statutory sick pay.

Remember, if you stop paying SSP and the employee is still off sick, you should complete the SSP1 form and send it to the employee so they can claim employment support.

The UK government states that to qualify for Statutory Sick Pay your employee should:

There are some exceptions to SSP which may mean your employees aren't eligible for it. These include those who have already had the maximum of 28 weeks and those who are already getting statutory maternity pay. In some cases, employees could have linked periods of sickness if they are regularly falling ill. When these linked periods last more than three years, the employee will not be eligible for SSP.

Breathe makes it easy to track the sickness of your employees, view their Bradford score, and communicate with senior management about absences. Get your employees the support they deserve with Breathe’s award-winning HR Software.

Enter your employee's salary:

Select the start and end dates of sick leave: